This spectacular log home sets amid 6.9 tabletop level acres in a beautiful area of the Cumberland Plateau. $355,000 |

|

Congress passed a bill extending the current $8,000 tax credit for persons buying a home who have not owned one in the past three years that was their principal residents. President Obama signed it this past Friday, November 6th, so it’s now official.

But the new bill has an addition for current Knoxville, TN homeowners who want to sell their current home and buy another. If you own your home now, sell it and buy another before April 30th of 2010 you probably qualify for a $6,500 tax credit like the ones buyers have enjoyed this year. ($3250 if you’re married and file separately).

As long as you have a sales contract dated April 30, 2010, you have up to 60 days past that date to get the newly purchased home closed.

The new extension also increased the income limits for all home-buyers. Single buyers can earn up to $125,000 and married couples can earn as much as $225,000.

Before there was no limitation on the cost of your new home; it’s now a maximum sales price of $800,000. I suppose the rationale for this is that the former income limits of $75,000 for a single taxpayer and $150,000 for married buyers was a self limiting mechanism that did not need to be spelled out. Now that selling an existing home enters into the mix with the potential for equity from selling an existing home, I guess Congress felt they needed some sort of purchase price cap.

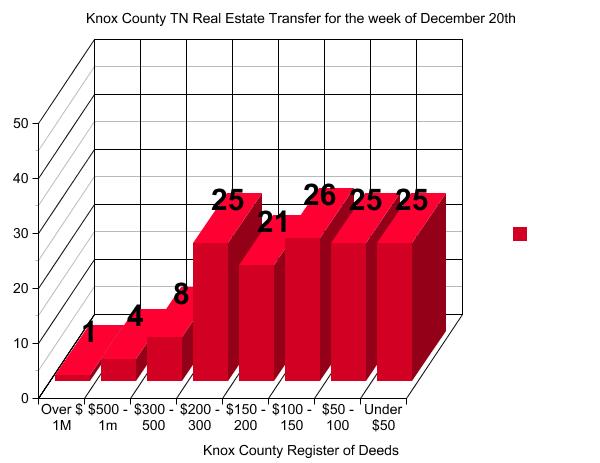

The income limits were increased in hopes the new higher ceilings will stimulate the purchase of more expensive home. Before the existing tax credit was mostly driving the sales of lower end homes priced at $150,000 and below. With the income limits now increased and current homeowners allowed to participate too that should raise the average sales price of Knoxville and Farragut homes bought with this program.

To cut down on some fraudulent tax returns submitted by taxpayers who did not qualify for the tax credit buyers now have to submit some documentation as proof you actually bought a home and that you qualify for the credit. I believe a copy of your HUD 1 form (closing statement) would qualify as proof but you should check with the IRS or your tax preparer to make sure.

Treasury Inspector General for Tax Administration J. Russell George told a House panel that more than 19,000 people filed 2008 tax returns claiming the credit for homes they had not yet purchased. George said his office had identified another $500 million in claims, by some 74,000 taxpayers, where there were indications of prior home ownership.

He told a House Ways and Means oversight subcommittee that they also found 580 taxpayers under the age of 18 who claimed $4 million in first-time home buyer credit. One was 4 years old.

“Some of our findings, while preliminary, are somewhat disturbing,” George said. Among the most striking instances of fraud include 4-year-olds, non-U.S. citizens and IRS employees inappropriately claiming the benefit, he said.

Below is a chart from the National Association of REALTORS® comparing the new tax credit extension to the current one and spelling out the terms and conditions.

Comparison chart showing the existing bill compared to the new, extended version.

So if you’ve been sitting on the fence waiting to buy or, if you couldn’t qualify because of needing some cash for closing costs, this new law levels the playing field for both new buyers and current homeowners who want to sell and buy.

www.KnoxvilleHomeCenter.com is a great place to get started looking at Knoxville and Farragut TN homes and listings for sale. Updated daily and NO REGISTRATION required to search to your heart’s content.

I would be delighted to help you get your current home sold and then buy another either in the Knoxville area or I can refer you to another top notch REALTOR in the city you’re moving to.

Please call or email with any questions about the tax credit or any buying and selling questions.

Knoxville, TN real estate sales and listings

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=53defe56-89d5-41fe-81e1-50c30e673ac1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=40cdba62-fd60-4052-8ec0-8ed9c5d221ee)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=76502724-f96b-42bc-971a-ffb5af01de8b)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=1d7ae80c-7ddc-4592-95b2-f25b5b0d46d2)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=fd94164c-0692-4e43-8540-86e20ead8a64)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=c5c1090b-d7a1-4d6f-b2e5-3abafa921507)