Knoxville area real estate market week of May 31st.

- Image by Getty Images via Daylife

Here’s the latest update on the Knoxville area real estate market. This week’s real estate transactions from the Knox County Register of Deeds is below.

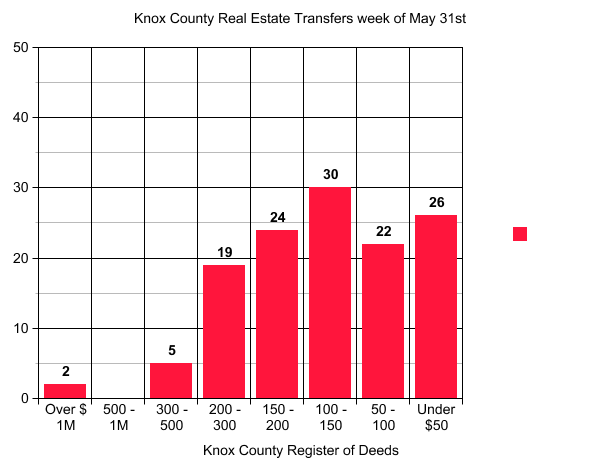

Weekly closings report from the Knox County Register of Deeds.

It appears that closed transactions stayed about the same as previous weeks; this week saw 124 total with the $100,000 to $150,000 price ranges still leading the pack. The upper end market remains flat.

Calculating the absorption rate in the 1 million dollar or higher price range we see a total of 11 closed transactions so far this year in Knox County. The Knoxville Area Association of Realtors MLS currently shows a total of 115 single family residential listings in that price range for Knox County. At the current rate of sales it will take the Knoxville area market 52.2 months or about 4.3 years to absorb (sell) them assuming no new listings come on the market at that time.

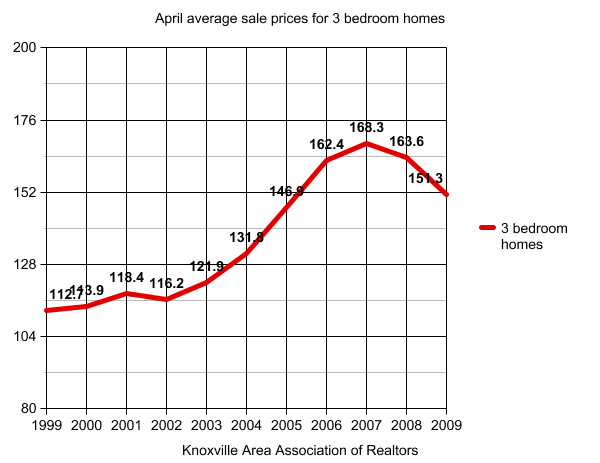

Some say the market is getting better. I wish I could join in their optimism but the facts just don’t support that notion at this time. Here’s what the Knox County Register of Deed’s weekly reports in the Knoxville News Sentinel look like for the year.

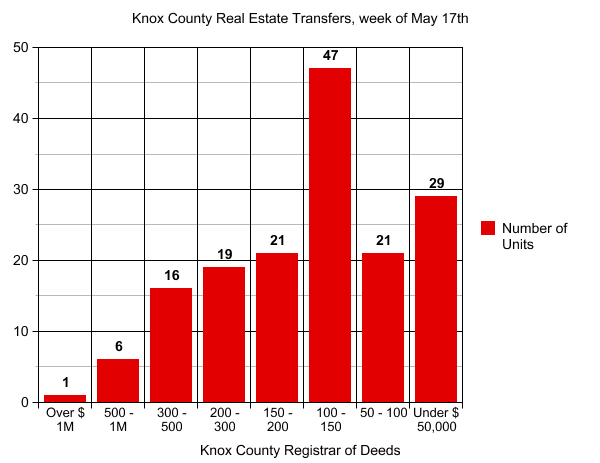

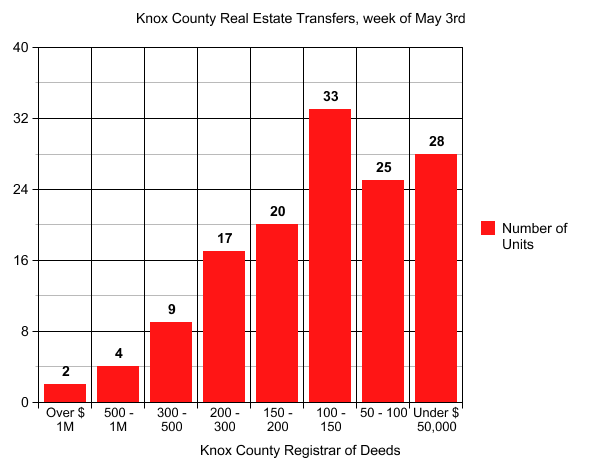

Weekly closed transactions from the Knox County Register of Deeds

Anecdotal stories like “we’re getting more phone calls in our office” or “I sold two houses last month” just don’t seem to be turning into a rise in sales for the area as a whole yet.

Here’s a tidbit straight from the horse’s mouth: “We need several months of sustained growth to demonstrate a recovery in housing, which is necessary for the overall economy to turn around,†said Lawrence Yun, chief economist for the National Association of Realtors.

Currently in the MLS there are 4,084 single family residential listing and another 1,089 condos for a total number of 5,173 homes for sale in just Knox County. As of May 31st I see a total of 1,650 closed sales year to date which is a 330 monthly average.

At that rate of sales it will take the Knox County market 15.6 months or just over a year, to sell today’s inventory at the current rate assuming no new listings come on the market which is not realistic since we average adding 2 to 4 thousand new listings a month!

Got a house in the greater Knoxville are you need to sell? My best professional advice is to hold off a few months if you can.

Unfortunately some sellers can’t wait and have to sell now so what do they do? Here are some things, based on my experience, that will tip the odds of selling in your favor:

- Number one on my list would be a very aggressive list price. I’m seeing homes on the market now that are not selling for what the owners paid for them as long as 3 years ago. If you’re a seller you’re competing with both a lot of other houses and the continuing stream of bad economic news that your potential buyers are bombarded with day after day. “Layoffs, hundreds lost jobs, downturn, worst economy in (take you choice of numbers), recession, etc.†It’s no wonder buyers are scared to buy if they can’t have confidence they’re have a job next week or next month.

- I also believe it’s equally important that you do whatever it takes to put your house in showroom condition. You have probably seen what auto dealers do with late model trade in cars. If you haven’t, they shampoo or replace the carpets in the car including the trunk, wax and buff the exterior until it shines, steam clean the engine, shine up the tires, and generally make it as appealing as possible and as close to new looking as they can get it. You have to do the same with your house. Stop thinking about it as the place you’ve had Christmas with your family, watched your kids take their first steps, and other emotional ties and start thinking of it as a piece of merchandise you’re trying to sell. I have a free 52 page eBook titled “450 ways to make your home sell faster!” I’ll be happy to send you if you’ll just send a blank email to:[email protected]

- Offer some buyer incentives, especially important in the lower price ranges. With all the news about the mortgage market lenders are more strict than ever about buyer requirements. Whereas in the past they used to use a magnifying glass on buyers they’re now using microscopes and requiring more documentation. I recall a transaction I had that closed last week and I had to prove I was not the Jim Lee on the FHA mortgage fraud watch list and submit an affidavit that I had never lived in a certain city in Illinois. And I was not even a buyer or seller in this transaction; just the buyer’s agent.

- Be prepared to accept an offer from a qualified buyer that may be below your list price by a large discount if you want to sell. Buyers read the news too and realize they are in the driver’s seat. Having your house in showroom condition, aggressively priced, and perhaps offering to throw in 3-4% of the sales price to help a buyer get in very often makes the difference between a buyer and a ‘just looking’ prospect.

- Exposure to as many potential buyers as possible. Common sense says that the more people that are aware something is for sale and want that thing, the more it becomes worth to them. Right now over 80% of all buyers are looking on the Internet for houses for sale. If you’re house doesn’t have a good presence with lots of photos AND MOST IMPORTANT, isn’t easily findable by potential buyers, you’re not going to be able to create that demand that brings the best possible price no matter what the economic conditions and how much competition you may have.

Thinking of buying a home in the greater Knoxville area. NOW is the time if you have a steady job and good credit. It is a strong buyer’s market right now and conditions for buying may never be this good for you again.

Here’s what you have going for you as a buyer right now:

- The lowest interest rates in history which can give you a house payment cheaper than rent.

- A huge backlog of unsold homes with motivated sellers offering big discounts and/or buyer incentives to get their homes sold.

- The $8,000 federal tax credit some buyers that have not owned a home in the past 3 years can collect up until December 1st of this year.

- A number of other incentives designed to attract buyers such as the Tennessee Housing Development Authorities (THDA) program to advance buyers up to 3 1/12% of the purchase price as a down payment and then be repaid when that buyer collects on their tax credit.

Take a look at KnoxvilleHomeCenter.com to see what’s for sale in your price range and then let’s go pick one out.

Related articles by Zemanta

- Pending sales rise with improved affordability, buyer incentives (ballardnewstribune.com)

- How Realtors Get Paid (kristalsellsdenver.com)

- US home sales record slight rise (news.bbc.co.uk)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=5b4306a4-8caf-4666-85b6-5ea8ca31cbd0)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=a10ef82a-1920-4a14-a1bf-4b1276ee59ce)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=64c6ffbf-0d93-4710-826a-2f9d41918aae)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=31747c3f-fb4b-43fb-89cc-e7817f2ce5cd)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=974b412e-8d00-4208-9280-8b5d0beeec7d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=4aedf42d-f877-43ff-8841-f9886270fe85)