Knoxville real estate transfers for the week of June 7th

- Image by volunteerjim via Flickr

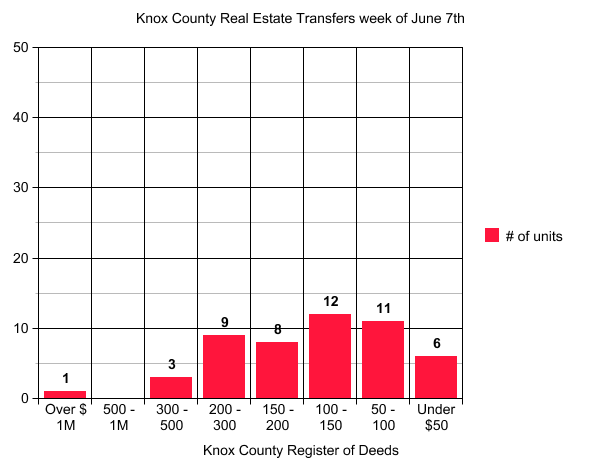

The first full week of June turned out to be a fizzle for real estate transfers recorded at the Knox County Register of Deeds office, dropping to just 50 recorded transfers from a high of 187 back on April 12 of 2009.

In fact I believe 50 is the worst week we’ve had thus far in 2009.

Knoxville real estate transfers for the past week

Here’s what some past weeks have looked like so far in 2009:

Knoxville weekly real estate deeds recorded at the Knox County Register of Deeds

Historically May and June have both been pretty strong sales months so just what the heck is happening now.

I believe the main factors depressing our market and sale is an overwhelming lack of consumer confidence towards buying big ticket items like houses, a continuing climb in unemployment numbers, and unfortunately, plunging home values driven by distressed sales (foreclosures & short sales) which now account for 45% of the market.

If someone in your neighbor or area sells their home in a distress sale that affects the values of all homes in that area.

Reuters news service said in a recent article: “Even when the economy begins to grow, analysts expect only a tepid recovery. Plunging home values and rising unemployment have forced consumers to cut spending, and households are expected to continue to rebuild savings for months to come.”

And to further kick the housing industry when it’s down, mortgage interest rates ROSE to their highest levels since December of 2008!

“NEW YORK (Reuters) – U.S. mortgage rates surged to their highest in almost six months in the latest week, despite government efforts to keep rates at low levels that will help the hard-hit housing market begin to recover.

Demand for home refinancing loans, which had been spurred by low mortgage rates, has dropped recently. Even lower rates, however, had been having limited impact on demand for loans to purchase homes.”

Spring is traditionally the peak home buying season so I don’t look for the sales numbers to improve any time soon.

On a brighter note it still is a very strong buyers market for those with good credit and good job prospects. The $8,000 (or 10% whichever is less) federal tax credit remains in effect until December 1st of 2009.

Our Tennessee Housing Development Authority (THDA) has in place a program that will let you borrow from them up to 3.5% of a home’s purchase price (which just happens to the the minimum down payment with FHA financing) and repay them at 0% until 2010 using your $8,000 tax credit.

You may find that you can now buy a house cheaper than your current rent. A fixed rate payment will never increase over the life of your loan unlike rent payments.

See all Knoxville area homes for sale including foreclosures and short sales at www.KnoxvilleHomeCenter.com\

Give me a call or send an email and lets talk about the remaining benefits of home ownership and get you into a home of your own while conditions are so much in a buyer’s favor.

Here’s just a couple of the 5,140 houses and condos currently for sale in Knox County.

Attractive northeast Knoxville home priced at $179,900

West Knoxville and bargain priced at $149,900.

Related articles by Zemanta

- U.S. mortgage applications sink 14% (money.cnn.com)

- The $8,000 First-Time Home Buyer Tax Credit Program Expands: 5 Things to Know (usnews.com)

- Looking for a mortgage? You might want to … [Fha] (consumerist.com)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=5046ae80-5302-4010-b80c-ebe5dc1259cd)